Tommorow’s Success

Today’s Plan

Reach financial independence faster with a personalized, detailed financial plan designed just for you.

Partnered with

What Is Included

In Your Financial Plan?

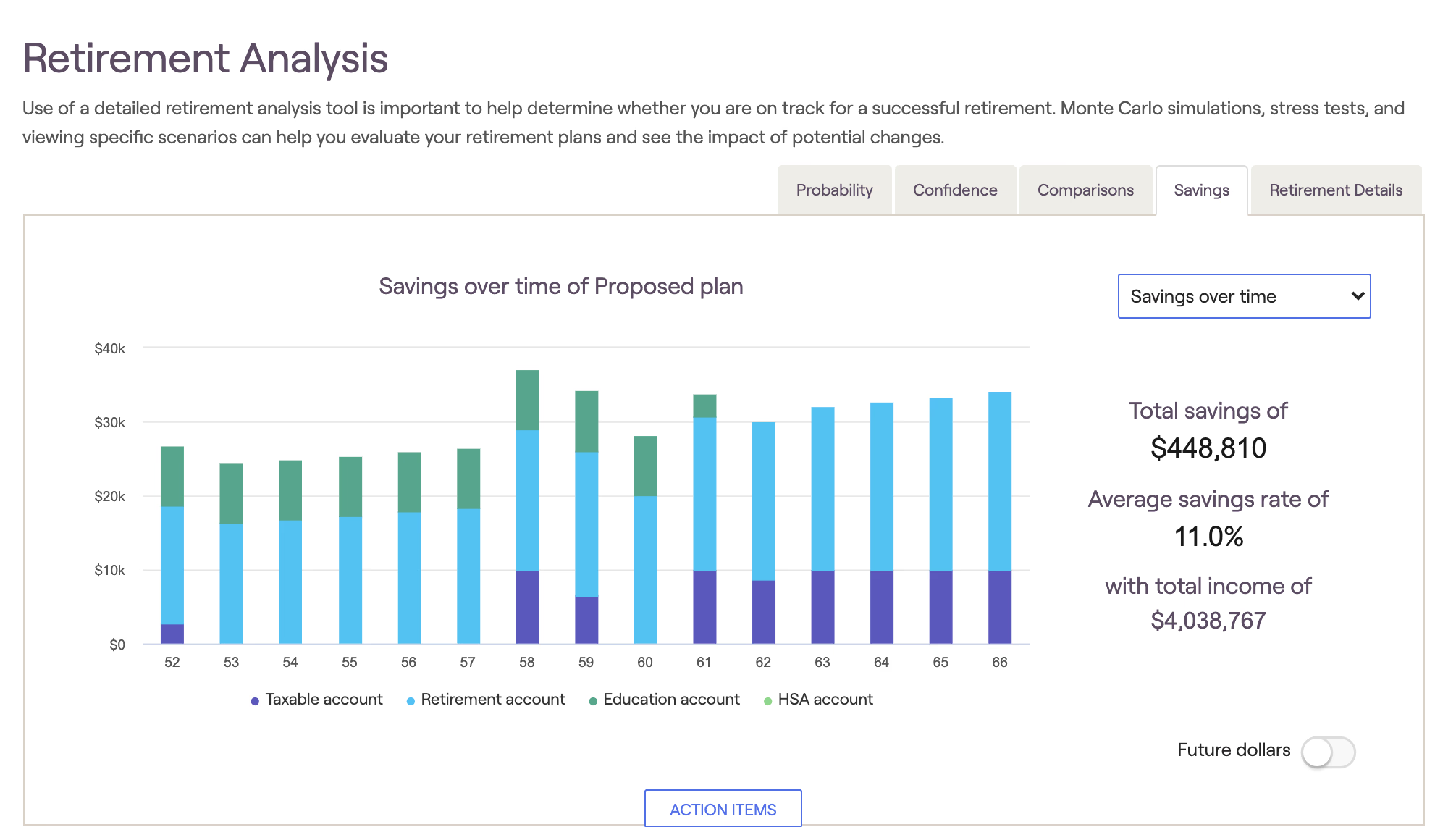

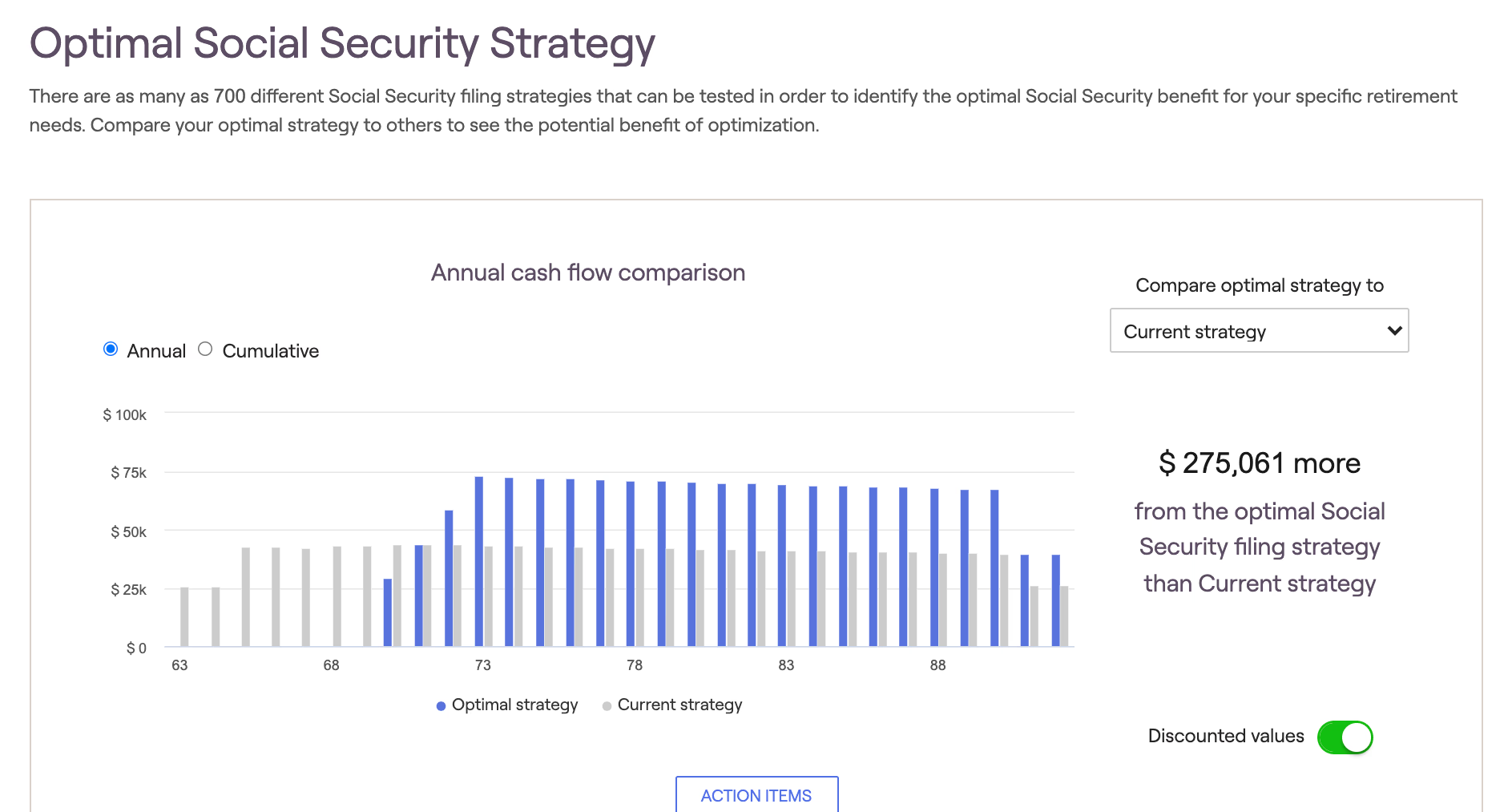

Interactive Retirement Planning

Clearly illustrate multiple scenarios, stress tests, and more. Your clients will thank you for helping them make their golf-in-the-morning, beach-all-day dreams a reality.

Net Worth

Visually explore all household assets and liabilities, insurance policies and trust-owned assets. Each item is color-coded by type and organized by owners for an easy review. Best of all, any edits made in the visual layout are automatically updated in the client’s plan.

Insurance Needs Review

Help protect your clients in the event of situations such as disability or death. Evaluate their needs in different situations and identify ways to ensure their success.

Risk Tolerance Assessment

Incorporate risk assessment as part of your holistic financial planning process. Show how each client household’s risk score relates to their investment strategies and probability of success.

Empower Your Clients with Cutting-Edge Tools

Leverage modern, intuitive tools that simplify financial planning and deliver clear, actionable insights. Elevate your client experience with personalized strategies that drive results.

Comprehensive Solutions

For Your Financial Future

we are committed to delivering personalized strategies and expert guidance that empower you to achieve financial security and peace of mind.

Investment Planning

Creating a customized investment strategy based on your risk tolerance, goals, and financial circumstances.

Financial Assessment

Conducting a thorough evaluation of your financial situation to identify strengths, weaknesses, and opportunities.

Retirement Planning

Crafting a personalized retirement plan to secure your future and maintain financial stability in later years.

Tax Planning

Optimizing tax strategies to minimize liabilities and maximize savings for long-term financial success.

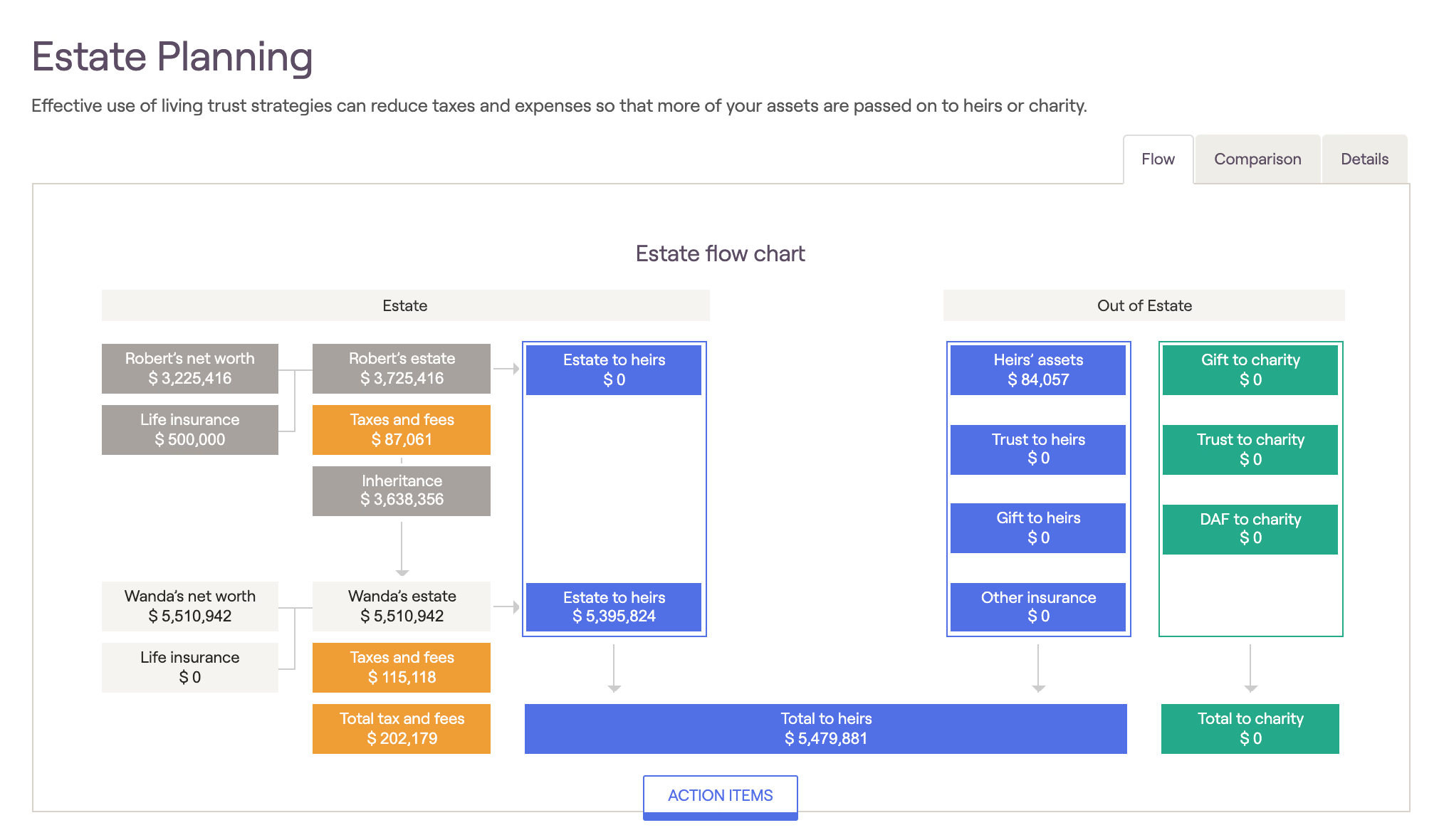

Estate Planning

Designing strategies to protect and transfer your wealth, ensuring your legacy is preserved.

Education Planning

Developing tailored plans to fund educational goals while balancing other financial priorities.

1.

Initial Consultation

Discuss your financial goals, needs, and future aspirations in detail.

2.

In-Depth Analysis

We evaluate your financial situation, risks, and objectives comprehensively.

3.

Personalized Strategy

Create a tailored financial plan focused on growth and security.

4.

Ongoing Support

Provide continuous guidance, adjusting your plan for long-term success.

About Me

Growing up in a family generationally involved in Sierra Leone’s diamond

industry, I have always had exposure to finance & business cash flow, and I had a fascination for data, charts, and numbers.

Passionate about helping individuals and families achieve financial well-being through strategic planning and informed decision-making. As a Certified Financial Planner, I bring expertise in wealth management, retirement planning, and investment strategies.

As a Rising Leaders Board Member at the Children’s Cancer Center, I am dedicated to making a difference in the lives of young warriors and their families. For the past eight years, I have been working towards creating a brighter and healthier future for children battling cancer.

Ready to Secure Your Financial Future?

Take the First Step Today

Get expert guidance with a personalized financial plan designed to help you achieve your goals.

Stay Informed with Our Financial Insights

Sign up for our newsletter to receive expert tips, market updates, and strategies for achieving financial independence directly in your inbox.

Address: 610 E Zack St, Suite 110-22,

Tampa, FL33611

Disclaimer: The content provided on this website is for informational purposes only and should not be considered professional financial, legal, or tax advice. While we strive to ensure the accuracy of the information, we cannot guarantee that all details are up to date or applicable to your specific situation. Each individual’s financial circumstances are unique, and you should consult with a qualified financial advisor, tax professional, or legal expert before making any decisions. Your Financial Planner does not assume any liability for losses or damages incurred as a result of actions taken based on the content provided. All investment strategies and financial plans carry inherent risks, and past performance does not guarantee future results.